the psychology of money doctype:pdf

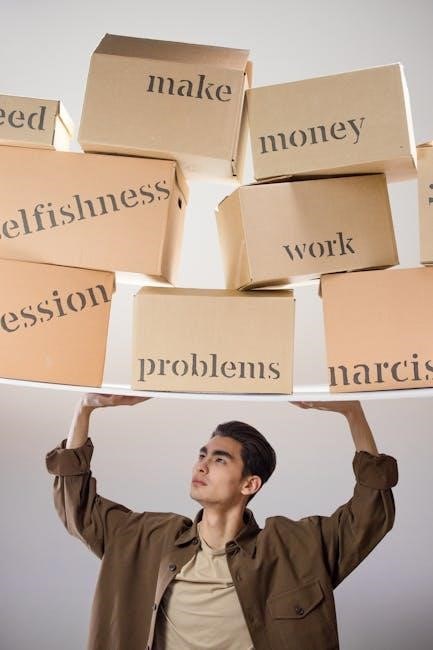

The psychology of money explores how emotions, behaviors, and experiences shape financial decisions. It delves into the balance between risk and humility, emphasizing that money is both a tool for survival and a trigger for greed. Understanding these dynamics is essential for achieving financial success and happiness.

1.1 Overview of Morgan Housel’s Perspective

Morgan Housel’s perspective on the psychology of money emphasizes the role of behavior and emotions in financial decisions. He highlights the paradox of taking risks to build wealth and the necessity of humility to maintain it. Through storytelling, Housel illustrates timeless lessons on greed, happiness, and wise money management, drawing from the experiences of diverse individuals who have either achieved or lost significant wealth.

1.2 The Behavioral and Psychological Aspects of Wealth

Wealth creation involves complex psychological dynamics, including cognitive biases, risk tolerance, and emotional responses. Behavioral factors, such as fear, greed, and confidence, significantly influence financial decisions, often leading to irrational choices. Understanding these psychological aspects is crucial for managing wealth effectively and avoiding common pitfalls that hinder long-term financial success.

The Importance of Money Beyond Economics

Money extends beyond economics, serving as a tool for survival, freedom, and security, while also influencing social status, emotional well-being, and personal aspirations.

2.1 Money as a Tool for Survival and Freedom

Money is fundamental for survival, providing basic needs like food, shelter, and healthcare. Beyond survival, it grants freedom—freedom to pursue opportunities, make choices, and achieve personal goals. Financial independence reduces vulnerability, offering a safety net against life’s uncertainties and enabling individuals to thrive beyond mere existence.

2.2 The Emotional and Social Significance of Financial Success

Financial success deeply impacts emotions and social interactions, often influencing self-esteem and security. It can foster confidence and respect but may also lead to greed or dissatisfaction. Money’s emotional weight varies, as some find happiness in wealth while others struggle with its pressures, highlighting its dual role in shaping identity and societal standing.

The Role of Risk and Optimism in Wealth Creation

Risk and optimism are crucial for wealth creation, as they drive innovation and investment. Balancing boldness with caution ensures sustainable growth, fostering resilience and long-term success.

3.1 The Paradox of Taking Risks to Build Wealth

Taking risks is essential for wealth creation, yet it contrasts with the caution needed to preserve it. Risk-taking fosters growth, while excessive caution may stagnate progress, creating a delicate balance between boldness and prudence to achieve financial success.

3.2 The Balance Between Confidence and Humility in Financial Decisions

Confidence drives bold financial decisions, but humility tempers overconfidence, preventing reckless choices. Balancing these traits ensures prudent risk-taking and adaptability, fostering sustainable wealth management and long-term financial stability.

The Influence of Personal Experiences on Financial Behavior

Personal experiences, such as upbringing and past financial setbacks, profoundly shape financial attitudes and decisions, influencing risk tolerance and wealth management strategies.

4;1 Generational and Background Differences in Risk Tolerance

Generational and background differences significantly impact risk tolerance. For instance, individuals from older generations may be more cautious due to historical financial crises, while younger generations, exposed to tech-driven markets, tend to embrace higher risks. Personal history and cultural background also play a role, shaping perceptions of financial stability and opportunity. These differences influence investment choices and wealth-building strategies.

4.2 How Early Life Experiences Shape Financial Attitudes

Early life experiences profoundly influence financial attitudes. Childhood exposure to financial stress or stability shapes perceptions of money, affecting risk tolerance and spending habits. Traumatic events, like economic downturns, can instill caution, while stable environments may foster confidence. These formative experiences often guide financial decision-making, emphasizing the role of upbringing in shaping long-term financial behaviors and strategies.

The Psychology of Investing and Wealth Management

The psychology of investing reveals how cognitive biases influence decisions. Emotional stability and discipline are crucial for managing wealth effectively and avoiding irrational financial behaviors.

5.1 The Impact of Cognitive Biases on Investment Decisions

Cognitive biases significantly influence investment decisions, often leading to irrational choices. Confirmation bias and loss aversion are common, causing investors to cling to failing strategies or avoid risks. Emotional stability and discipline are essential to overcome these biases. Understanding these psychological pitfalls helps investors make more rational, data-driven decisions, fostering long-term financial success and reducing costly errors. Practical strategies, like diversification and seeking expert advice, can mitigate their impact.

5.2 The Role of Discipline in Sustaining Financial Success

Discipline is the cornerstone of maintaining financial success, ensuring consistency in saving, investing, and spending. It prevents impulsive decisions and fosters resilience during market volatility. By adhering to budget plans and avoiding get-rich-quick schemes, disciplined individuals build long-term stability. Over time, discipline becomes a habit, separating those who sustain wealth from those who squander it, ultimately leading to financial freedom and peace of mind.

The Paradox of Wealth and Happiness

Wealth often fails to guarantee lasting happiness, as happiness plateaus despite increasing income. Money meets basic needs but doesn’t fulfill emotional or psychological desires, revealing greed’s endless cycle.

6.1 The Limits of Wealth in Achieving Long-Term Satisfaction

While wealth provides comfort, it doesn’t guarantee lasting satisfaction. Research shows that beyond meeting basic needs, additional wealth doesn’t proportionally increase happiness. People often adapt to higher income levels, leading to a “hedonic treadmill.” True fulfillment comes from non-material factors like relationships, purpose, and personal growth, highlighting money’s limited role in sustained happiness.

6.2 The Psychology of Financial Dissatisfaction and Greed

Financial dissatisfaction often stems from emotional and psychological factors, such as social comparison and the fear of missing out. Greed, driven by the pursuit of more, can lead to an endless cycle of dissatisfaction, as the mind often tricks itself into believing that the next achievement or acquisition will bring fulfillment. This mindset can undermine true satisfaction and perpetuate a never-ending chase for wealth.

Timeless Lessons on Managing Money Wisely

Managing money wisely involves balancing risk and caution, understanding the psychology of greed, and fostering discipline. It requires recognizing that true wealth is not just about accumulation but also about maintaining emotional and financial stability over time.

7.1 Stories of Financial Success and Failure

Stories of financial success and failure reveal timeless lessons on wealth management. They highlight how greed, discipline, and humility shape outcomes, emphasizing the psychological aspects of money. These narratives, from geniuses to everyday individuals, illustrate the importance of balancing risk and caution, underscoring that financial success is as much about behavior as it is about intelligence or luck. Wisdom lies in learning from others’ journeys.

7.2 Practical Strategies for Improving Financial Behavior

Improving financial behavior requires discipline, self-awareness, and simple yet effective strategies. Start by setting clear financial goals, automating savings, and avoiding impulsive spending. Use budgeting tools to track expenses and prioritize needs over wants. Regularly review financial decisions to identify and correct biases. Cultivating patience and long-term thinking helps avoid get-rich-quick schemes, fostering sustainable wealth growth and financial stability over time.

The Role of Education and Awareness in Financial Literacy

Financial literacy is the foundation of smart money decisions. Education helps individuals understand behavioral finance, reducing cognitive biases and fostering informed choices. Awareness of psychological pitfalls like greed and emotional spending is crucial for long-term financial stability.

8.1 The Importance of Understanding Behavioral Finance

Understanding behavioral finance is crucial for making rational decisions. It reveals how cognitive biases, emotions, and social influences shape financial choices, often leading to irrational behaviors like greed or fear. By recognizing these patterns, individuals can avoid costly mistakes, develop disciplined strategies, and improve their ability to manage money effectively, ensuring long-term financial stability and success.

8.2 The Impact of Financial Education on Decision-Making

Financial education empowers individuals to make informed decisions by understanding market dynamics and behavioral biases. It equips them with tools to navigate complexities, fostering disciplined approaches to saving and investing. Educated individuals are less prone to emotional decisions, enabling them to build sustainable wealth and achieve financial freedom through mindful, data-driven strategies.

The Future of Money and Wealth in a Changing World

The evolving financial landscape brings new psychological challenges, as digital currencies and global economic shifts reshape perceptions of wealth. Understanding these changes is crucial for adapting strategies and maintaining financial stability in an uncertain future.

9.1 The Psychological Challenges of Modern Financial Systems

Modern financial systems present unique psychological challenges, such as navigating market unpredictability and managing cognitive biases. The rise of digital currencies and AI-driven decisions adds complexity, requiring individuals to balance trust in technology with traditional financial instincts. These shifts demand heightened awareness and adaptability to avoid pitfalls like overconfidence or fear-driven decisions in an increasingly volatile global economy.

9.2 The Evolution of Money and Its Psychological Implications

The evolution of money, from physical currencies to digital forms, has reshaped psychological perceptions. Digital currencies and contactless payments create a sense of detachment, influencing spending habits and financial decisions. This shift also raises concerns about trust in institutions and the security of digital transactions, fundamentally altering how individuals perceive value and interact with money in the modern world.

Mastering the psychology of money involves understanding behavior, emotions, and financial decisions, enabling individuals to achieve long-term success and happiness through disciplined and informed strategies.

10.1 The Interplay of Behavior, Emotions, and Financial Success

Behavior and emotions significantly influence financial success. Fear, greed, and optimism shape decisions, often overriding logic. Understanding these psychological dynamics helps individuals adopt disciplined strategies, balancing risk and humility. Recognizing emotional triggers and cultivating self-control fosters better financial outcomes, ultimately aligning behavior with long-term goals and happiness.

10.2 The Path to Financial Freedom and Happiness

Financial freedom and happiness stem from mastering the psychology of money. It requires discipline, avoiding greed, and understanding that wealth is a means to an end, not the end itself. Timeless lessons emphasize balancing behavior, emotions, and logic. True freedom lies in aligning financial actions with personal values, fostering long-term satisfaction and peace of mind.

Related posts:

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

Leave a Reply

You must be logged in to post a comment.